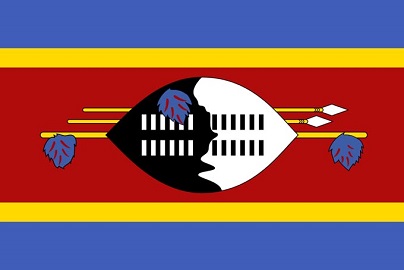

Eswatini

| Extent of IFRS application | Status | Additional Information |

|---|---|---|

| IFRS Accounting Standards are required for domestic public companies | IFRS Standards required for listed companies, financial institutions, and government-owned companies. | |

| IFRS Accounting Standards are permitted but not required for domestic public companies | ||

| IFRS Accounting Standards are required or permitted for listings by foreign companies | Required. | |

| The IFRS for SMEs Accounting Standard is required or permitted | The IFRS for SMEs Standard is one of the reporting options with which SMEs in eSwatini are permitted to comply. | |

| The IFRS for SMEs Accounting Standard is under consideration |

Profile last updated: 16 June 2016

Eswatini

RELEVANT JURISDICTIONAL AUTHORITY

COMMITMENT TO GLOBAL FINANCIAL REPORTING STANDARDS

Yes.

The Companies Act 2009 (alternate link) states that, for all companies, “the annual financial statements of a company shall be in conformity with Swaziland and International Financial Reporting Standards”.

The World Bank’s November 2012 ROSC Report on Swaziland (renamed 'Eswatini' in 2018) reaffirms the requirement to comply with IFRS Standards.

The Eswatini Institute of Accountants’ five-year strategic plan, adopted in 2012, states that adoption of IFRS Standards is a strategic goal of the EIA. The strategic plan states that the Institute should:

- “Develop a plan for the adoption of IFRS….”

- “Put mechanisms in place to monitor and enforcement of compliance (or to deal with non-compliance)”.

Yes.

See above.

Chapter XI Section 247 of the Companies Act 2009 requires application of IFRS Standards. Further, the EIA has approved the adoption of IFRS Standards and the IFRS for SMEs Standard, as well as International Standards on Auditing.

As noted above, the World Bank’s November 2012 ROSC Report on Swaziland states: “The Companies Act 2009 requires financial statements to comply with IFRS and ‘Swaziland Financial Reporting Standards’ (although these standards do not exist) and be in accordance with the provisions of Schedule 3 of the Companies Act. Thus, companies are required to identify any gaps between the IFRS and Companies Act disclosure requirements and report on both in the auditor’s report — an onerous requirement. The requirement for all companies, except the exempt private companies, to apply IFRS is difficult and costly for small and medium-size companies. Some legislation and regulations refer to non-existent accounting standards (eg generally recognized accounting practice).”

The ROSC Report goes on to say: “The Companies Act allows any private company to elect to dispense from presenting annual financial statements and reports before a general meeting in the current and subsequent years. This is a significant weakness in the financial reporting statutory framework as some of the private companies may be a public interest enterprise, which should be required to present financial statements before the annual general meeting for the benefit of stakeholders.”

Although Section 247 of the Companies Act 2009 requires application of IFRS Standards, the jurisdiction acknowledges that IFRS Standards are often not followed, and there are no sanctions for companies not applying IFRS Standards.

EXTENT OF IFRS APPLICATION

For DOMESTIC companies whose debt or equity securities trade in a public market in the jurisdiction:

The Companies Act requires IFRS Standards for the following classes of companies even if their securities do not trade in a public market:

- Public companies

- Public enterprises

- Banking institutions

- Non-banking financial institutions

- Insurance companies

- Retirement funds

Under the Act, other classes of companies whose securities do not trade in a public market may elect not to publish financial statements. If they do publish financial statements, the Companies Act permits IFRS Standards. Alternatively, the EIA approved compliance with the IFRS for SMEs Standard effective in 2010.