The IASB held a series of outreach events on its revised proposals for the accounting for insurance contracts, published on 20 June 2013. Some of them took form of the discussion forums and were organised in conjunction with national standard setters and others. Between May 2013 and November 2013 we met with constituents in 186 individual and group meetings, including a series of discussion forums in 18 countries.

Outreach events are an important part of the IASB's due process because they enable board members and staff to hear the views of participants directly. Some events take the form of round-table meetings or discussion forums with multiple participants.

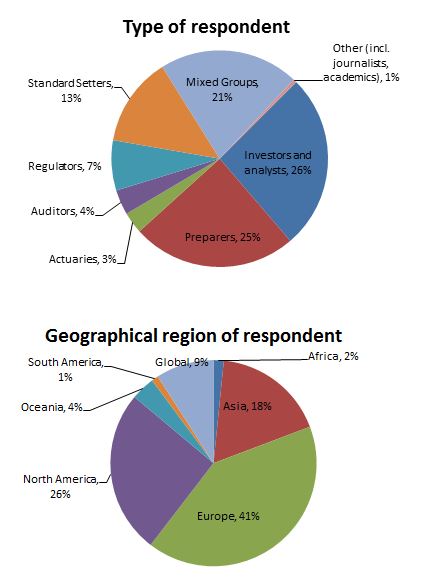

Our outreach plan aimed to ensure a broad coverage of views, and focused on the biggest insurance markets. However, we also sought to balance outreach in the biggest jurisdictions with outreach in smaller markets that are expected to grow, and in markets with which we have had less interaction. The statistics regarding our outreach activities are shown in the following diagrams.

Read the staff summary of outreach and comment letter analysis on revised Exposure Draft.

In addition, we summarise our outreach actvities by jurisdiction below. Our field work with entities in these jurisdictions is described in Agenda Paper 2C Fieldwork.

International

We discussed our proposals with international bodies as follows:

- Standard-setters: through the Accounting Standards Advisory Forum (ASAF), the International Federation of Accounting Standard-Setters (IFASS) and the World Standard-Setters (WSS). The attendees at those meetings were able to comment on how the proposals were regarded in their jurisdictions.

- Regulators: through the International Association of Insurance Supervisors accounting and auditing subcommittee.

- Actuaries: through the International Actuarial Association.

- Auditors: through participation at events organised by accounting firms, and we made ourselves available at some of their internal meetings held to formulate their global response.

- Users of financial statements: through the Insurance Corporate Reporting Users Forum (CRUF), which included analysts from Europe, the US and Japan.

Asia

We conducted outreach in China, Hong Kong, India, Japan, Malaysia, Singapore, South Korea and Taiwan. Those countries represented more than 90 per cent of the Asian market, in terms of total premiums written.

Japan

In Japan, we continued to meet with the General Insurance Association of Japan and the Life Insurance Association of Japan. Those organisations have continued to play an active role in the due process. We also met with a large non-insurer with large insurance operations in Japan.

We met with Japanese users of financial statements in individual meetings and through the Japan branch of the Corporate Reporting Users Forum and the Securities Analysts Association of Japan.

China

China has implemented an accounting standard for insurance contracts based on the IASB’s proposals. Accordingly, the views of Chinese companies provided a unique insight into the implementation of the proposals. IASB members and staff held discussion forums with users of financial statements, audit firms and companies. We also paid an official visit to the Chinese regulator, the Chinese Insurance Regulatory Commission.

Korea

We held a half-day discussion forum attended by preparers and regulators, covering both life and non-life insurance. We also met with the Korean regulator.

Other Asia—Hong Kong India, Malaysia, Taiwan and Singapore

The remaining Asian countries have limited insurance markets (less than ten per cent of total premiums). Nonetheless, as insurance markets are growing in many of those countries, and because we sought to understand the difficulties of implementing the proposals in smaller countries, we held discussion forums and other meetings in Hong Kong, India, Malaysia, Taiwan and Singapore.

Europe

In Europe, the IASB and staff have had extensive input from preparers throughout the whole process, which were largely organised through the CFO Forum and InsuranceEurope. We held discussion forums, hosted by local standard setters and other organisations, in the following countries:

- France;

- Germany;

- Italy;

- Sweden, attended by representatives from Denmark, Finland and Sweden;

- Switzerland; and

- UK.

Those meetings were generally attended by a mix of preparers, auditors, regulators, actuaries and (sometimes) users of fianncial statements. Those meetings supplemented the active dialoague we have had with EFRAG TEG and with the EFRAG’s Insurance Activities Working Group, which is made up of preparers, actuaries and auditors.

We discussed our proposals with European regulators through the ESMA project group and EIOPA.

In addition, we held 13 private meetings with European analysts.

Americas

US

We held two discussion forums in New York, one focused on foreign private issuers and one focused on US domestic companies. In addition, we have:

- had an active dialogue with the American Council of Life Insurers throughout the comment letter period;

- held a series of meetings with US analysts, both at the beginning of the exposure period (where we specificaly discussed the interaction with the classification and measurement proposals) and at the end of the exposure period;

- met with the American Academy of Actuaries; and

- attended the FASB’s round tables on the proposals in the FASB’s Exposure Draft.

Canada

We held formal meetings in Toronto as follows:

- two discussion forums on life issues;

- one discussion forum on non-life issues; and

- one discussion forum on use of financial statements.

We also had private meetings with regulators, users of financial statements, and one meeting with the Canadian corporate reporting users forum.

In addition, we have a regular dialogue with the Canadian integrated regulator, the Office of the Superintendent of Financial Institutions, and we have participated in meetings of the Canadian Insurance Accounting Task Force, through which the AcSB formulate their views, and held various private meetings with users of financial statements and preparers.

Latin America

Insurance markets in Latin America are concentrated in Brazil and Mexico. Accordingly, we held a discussion forum in each of São Paulo and Mexico City.

Oceania

90 per cent of the insurance market in Oceania is concentrated in Australia. We held a discussion forum in Sydney by videoconference, and obtained input on another discussion forum held in Melbourne. In addition, we held a videoconference for Australian users of financial statements.

Africa

The vast majority of the insurance market in Africa is concentrated in South Africa. We attended a user round table and various events arranged by the local standard-setter, SAICA.