By IASB Chair Andreas Barckow and ISSB Chair Emmanuel Faber

The benefits of connectivity were an important consideration when the IFRS Foundation created the International Sustainability Standards Board (ISSB) to operate alongside the International Accounting Standards Board (IASB). Stakeholders consistently highlighted the benefits to be gained from having two standard-setting boards within the Foundation, both focused on providing information to inform investment decisions.

In this article, we explain what we mean by connectivity, why it matters and what benefits it can deliver.

Connectivity in reports

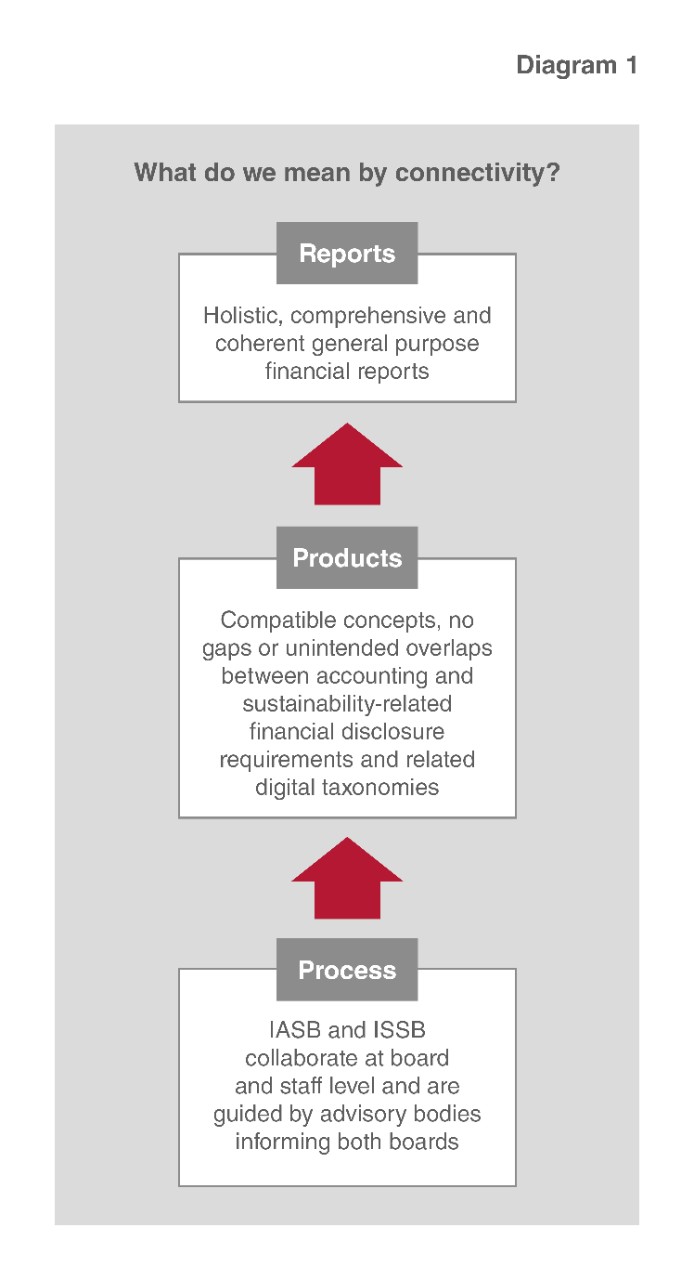

The ultimate outcome of connectivity is holistic, comprehensive and coherent general purpose financial reports. Connectivity in our products and connectivity in our processes contribute to that goal (see Diagram 1).

Investors are the primary audience for general purpose financial reports, which include sustainability-related financial disclosures and financial statements (see Diagram 2).

Sustainability-related financial disclosures and financial statements complement each other. For example, sustainability-related financial disclosures may explain the sustainability-related risks and opportunities arising from an entity’s activities and its assets and liabilities. Such disclosures may also provide early indications of matters that will subsequently be reflected in financial statements. For example, a company’s commitment to net zero emissions could, over time, result in liabilities being reported in the financial statements.

Investors need general purpose financial reports to give them a holistic, comprehensive and coherent picture of a company. They want to understand how matters reported in financial statements and in sustainability-related financial disclosures are connected.

Connectivity in product

To achieve connectivity in reports we need connectivity in our products―our Standards and digital taxonomies that facilitate digital reporting. Connectivity in our products is also important to companies because, increasingly, the same people within a company prepare both the financial statements and sustainability-related financial disclosures. So it is important that the language in IFRS Accounting Standards and IFRS Sustainability Disclosure Standards is consistent and that the requirements work well in combination.

Together, we can ensure that there is compatibility of concepts and that there are no gaps or unintended overlaps between IASB and ISSB Standards and our digital taxonomies.

We can already point to some first tangible connectivity in our products. Examples include1:

- the many concepts and terms in IASB Standards that are used in the ISSB’s first two Standards, S1 and S2;

- the requirement in S1 for sustainability-related financial disclosures to be provided with the financial statements, as part of a company’s general purpose financial report;

- the requirements in S1 and S2 for companies to explain how sustainability-related risks and opportunities (and climate-related risks and opportunities) are reflected in the financial statements and to use assumptions consistent with the financial statements when applicable; and

- the IASB’s new project on Climate-related Risks in the Financial Statements, which will use learnings from the ISSB’s work on S1 and S2. Read this article by Andreas Barckow about this new project.

.

Connectivity in process

To achieve connectivity in our products, we are building connectivity in our processes. We have established practices to facilitate knowledge sharing and coordination between the IASB and the ISSB. For example, the boards and staff regularly update each other on their activities during and between public board meetings.

Engagement between the boards and staff enables us to identify and address common issues and to identify opportunities to use common language and concepts. This engagement includes staff of one board working on projects of the other board when relevant.

While there will be instances when it will be appropriate for the boards to consider technical issues together, connectivity in our products can be and has been achieved without joint board discussions.

Evolution over time

We are still in the early days of our connectivity journey―our work will evolve over time as we learn from each other and as the wider financial reporting ecosystem develops.

In its forthcoming consultation on agenda priorities the ISSB will ask its stakeholders for feedback on its work plan priorities including whether the ISSB should undertake a project to move beyond simply connecting information in the financial statements and sustainability-related financial disclosures to closer integration in reporting. The ISSB’s consultation will also ask stakeholders how such a project could be undertaken. For example, depending on the feedback that the ISSB receives on its work and priorities, this project could be a joint project between the two boards and it could build on the IASB’s Exposure Draft Management Commentary and/or the Integrated Reporting Framework, which has been a joint responsibility of the IASB and the ISSB since the IFRS Foundation consolidated with the Value Reporting Foundation in 2022.

We look forward to engaging with our many stakeholders as we work to deliver better information for better decisions.