This IASB Update highlights preliminary decisions of the International Accounting Standards Board (Board). The Board's final decisions on IFRS® Standards, Amendments and IFRIC® Interpretations are formally balloted as set forth in the Due Process Handbook of the IFRS Foundation and the IFRS Interpretation Committee.

The Board met on Tuesday 24 until Thursday 26 September 2019 at the IFRS Foundation's offices in London.

The topics, in order of discussion, were:

- Agenda Consultation

- Research Programme

- Implementation Matters—Onerous Contracts

- Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

- Business Combinations under Common Control

- Financial Instruments with Characteristics of Equity

- Interest Rate Benchmark Reform

- Rate-regulated Activities

- Management Commentary

- Disclosure Initiative

- Primary Financial Statements

- SME Standard review and update

- Subsidiaries that are SMEs

- Extractive Activities

- Post-implementation review of IFRS 10, IFRS 11 and IFRS 12

2020 Agenda Consultation (Agenda Paper 24)

The Board met on 24 September 2019 to discuss the staff’s proposed approach to the agenda consultation and to receive an oral update on the advice provided by the IFRS Advisory Council at its September 2019 meeting.

The Board indicated its support for the staff’s proposed approach which is to conduct outreach before the Board publishes a request for information. The objective of the outreach is to develop full descriptions of potential projects to include in the request for information.

The Board also indicated its support for the staff’s recommendation to provide a detailed list of potential projects in the request for information—described as Approach B in Agenda Paper 24.

Next steps

The staff will conduct outreach in the last quarter of 2019 and in the first quarter of 2020 with a view to drawing up a detailed list of potential projects for inclusion in the request for information. The Board will determine the content of the RFI at its future meetings.

Research programme update (Agenda Paper 8)

The Board met on 24 September 2019 to receive an update on its research programme. Information on the Board’s research programme is available here.

The Board noted that:

- on 10 September 2019 an article was posted on the Board’s website discussing the Board’s preliminary views on Goodwill and Impairment. The staff are drafting a discussion paper for this project and now expect it to be ready for publication in February 2020;

- the research project on Pension Benefits that Depend on Asset Returns is expected to restart in the fourth quarter of 2019, with the aim of asking the Board to review the research in the second half of 2020; and

- because other work has a higher priority, it is unlikely that work will start in the next few months on the pipeline projects, or on the post-implementation review of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations.

The Board was not asked to make any decisions.

Next step

The Board expects to receive the next update on its research programme in three or four months.

Implementation matters (Agenda Paper 12)

The Board met on 24 September 2019 to discuss implementation matters.

Onerous Contracts—Cost of Fulfilling a Contract (Agenda Paper 12)

The Board discussed feedback on the Exposure Draft Onerous Contracts—Cost of Fulfilling a Contract.

The Board decided to proceed with its project to make a narrow-scope amendment to IAS 37 to clarify which costs an entity includes in determining the ‘cost of fulfilling’ a contract for the purpose of assessing whether that contract is onerous.

It also tentatively decided to specify, as proposed in the Exposure Draft, that such costs comprise those that relate directly to the contract.

Next step

The Board will consider other aspects of the feedback on the Exposure Draft at a future meeting.

Classification of Liabilities as Current or Non-current (Amendments to IAS 1) (Agenda Paper 29)

The Board met on 24 September 2019 to finalise its amendments to paragraphs 69–76 of IAS 1 Presentation of Financial Statements. The amended paragraphs relate to the classification of liabilities as current or non-current.

The Board decided not to re-expose the amendments. All 14 Board members agreed with the decision.

The Board decided that the amendments should apply for annual reporting periods beginning on or after 1 January 2022. All 14 Board members agreed with the decision.

No Board member indicated an intention to dissent from issuing the amendments.

All 14 Board members confirmed they were satisfied that the Board has complied with applicable due process steps and has undertaken sufficient consultation and analysis to begin the balloting process for the amendments.

The Board met on 25 September 2019 to discuss the research project on Business Combinations under Common Control.

Agenda Paper 23A: When to apply which measurement approach

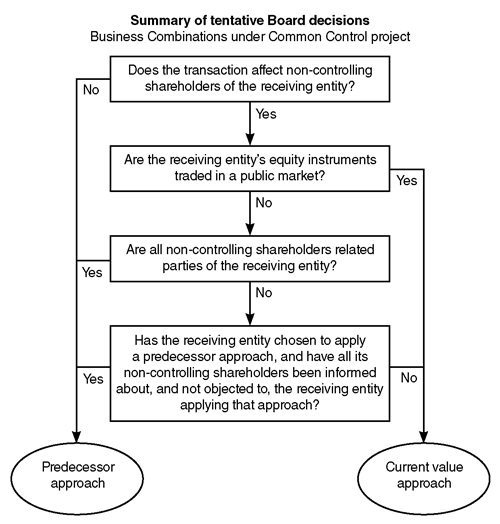

The Board tentatively decided that the forthcoming discussion paper on Business Combinations under Common Control (discussion paper) should not propose a single measurement approach for all transactions within the scope of the project.

Twelve of 14 Board members agreed and two disagreed with this decision.

The Board tentatively decided that the forthcoming discussion paper should set out a preliminary view that a current value approach based on the acquisition method should be required for transactions within the scope of the project that affect non-controlling shareholders of a receiving entity unless equity instruments of the receiving entity are not traded in a public market and one of the following conditions applies:

- all non-controlling shareholders are the receiving entity’s related parties; or

- the receiving entity chooses to apply a predecessor approach and all its non-controlling shareholders have been informed about, and not objected to, the receiving entity applying that approach.

IFRS Standards describe a public market as a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets.

Eleven of 14 Board members agreed and three disagreed with this decision.

The Board tentatively decided that the forthcoming discussion paper should propose a predecessor approach for all other transactions within the scope of the project.

All 14 Board members agreed with this decision.

Next steps

The Board will discuss at future meetings how a current value approach based on the acquisition method and a predecessor approach should be applied, and what information should be provided in the notes to financial statements.

Financial Instruments with Characteristics of Equity (Agenda Paper 5)

The Board met on 25 September 2019 to discuss the direction of the project, Financial Instruments with Characteristics of Equity. The Board tentatively decided on an approach that addresses practice issues by clarifying some principles in IAS 32 (Alternative C in Agenda Paper 5).

All 14 Board members agreed with this decision.

The Board also tentatively agreed with the objectives and criteria set out in Agenda Paper 5 to determine the scope of the project (subject to some suggestions) and directed the staff to prepare a detailed project proposal.

All 14 Board members agreed with this decision.

Next step

At a future Board meeting, the Board will discuss the detailed project proposal.

Interest Rate Benchmark Reform (Agenda Paper 14)

The Board met on 25 September 2019 for preliminary discussions about the project’s second phase. In particular, the Board discussed its preliminary scope and considered a timetable for future Board discussions.

The Board was not asked to make any decisions.

Next step

At its October 2019 meeting, the Board will discuss potential accounting issues related to the classification and measurement of financial instruments.

Rate-regulated Activities (Agenda Paper 9)

The Board met on 25 September 2019 to discuss the accounting model (model) being developed for regulatory assets and regulatory liabilities. Agenda Paper 9 provided, for information only, a summary of the tentative decisions made by the Board that determine the features of the model.

Further analysis of the regulatory agreement boundary (Agenda Paper 9A)

The Board tentatively decided that:

- when determining the boundary of a regulatory agreement, an entity should consider all the options that could affect that boundary, other than those options that the holder—the entity or the regulator—will have no practical ability to exercise in any circumstances; and

- when assessing whether an option affects the boundary of a regulatory agreement, an entity should consider neither the likelihood of that option being exercised nor either party’s intentions.

All 14 Board members agreed with this decision.

The Board tentatively decided to include in the exposure draft application guidance on the factors that an entity should consider in determining the boundary of a regulatory agreement. Such factors include the existing period of the regulatory agreement, options affecting the boundary and make-whole mechanisms.

All 14 Board members agreed with this decision.

The Board tentatively decided that when the boundary of a regulatory agreement changes, an entity should, in the period of the change:

- recognise the rights and obligations that will generate cash flows within the reassessed boundary as regulatory assets and regulatory liabilities if they meet the model’s recognition criteria;

- disclose these regulatory assets and regulatory liabilities separately from other additions to regulatory assets or regulatory liabilities in:

- the breakdown of regulatory income or regulatory expense for the period; or

- the reconciliation of the carrying amounts of regulatory assets and regulatory liabilities from the beginning to the end of the period; and

- disclose the circumstances that led to the recognition of such regulatory assets and regulatory liabilities, including the factors the entity considered in its reassessment of the boundary.

Thirteen of 14 Board members agreed and one disagreed with this decision.

Amendments to other IFRS Standards (Agenda Paper 9B)

The Board discussed whether amendments to other IFRS Standards or application guidance should be developed to clarify how an entity should apply the model.

The Board tentatively decided that no further amendments to other Standards or application guidance are needed beyond those which it tentatively decided in November 2018 and July 2019 to make or provide. However, the Board did request the staff to explore whether an amendment may be required to IAS 34 Interim Financial Reporting to require an entity to present regulatory income or regulatory expense and regulatory assets or regulatory liabilities as separate line items when its interim financial report includes a set of condensed financial statements.

All 14 Board members agreed with this decision.

Transition (Agenda Paper 9C)

The Board tentatively decided:

- that an entity that currently applies IFRS Standards should, in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, apply the model retrospectively to each prior reporting period presented;

- that a first-time adopter of IFRS Standards should apply the model at the date of transition to IFRS Standards, as defined in IFRS 1 First-time Adoption of International Financial Reporting Standards;

- to retain the deemed cost exemption in paragraph D8B of IFRS 1; and

- that an entity that currently applies IFRS Standards should be permitted to elect not to apply the model retrospectively to business combinations that occurred before the beginning of the earliest period presented (past business combinations).

All 14 Board members agreed with these decisions.

If an entity elects not to apply the model retrospectively to past business combinations, the Board tentatively decided that the entity should:

- recognise only those regulatory assets and regulatory liabilities arising from all past business combinations which still exist at the date of transition to the model; and

- recognise any resulting change as an adjustment to the carrying amount of goodwill. If that adjustment reduces the carrying amount of goodwill to zero, the entity should recognise any remaining adjustment in retained earnings or, if appropriate, another category of equity.

An entity electing not to apply the model retrospectively to past business combinations should apply that election to all of its past business combinations.

Twelve of 14 Board members agreed and two disagreed with this decision.

In some situations, an entity may have previously recognised regulatory balances that arose because a regulatory agreement gives the entity a right to include amounts relating to goodwill in future rate(s) charged to customers. The model does not treat such rights as regulatory assets and, therefore, they would not be recognised as assets. The Board tentatively decided that on transition to the model an entity that currently applies IFRS Standards and a first-time adopter of IFRS Standards should reclassify those balances to goodwill.

Eleven of 14 Board members agreed and three disagreed with this decision.

Next step

The Board now expects to publish an exposure draft in the second quarter of 2020.

Management Commentary (Agenda Paper 15)

The Board met on 25 September 2019 to discuss guidance to be included in the revised IFRS Practice Statement 1 Management Commentary (Practice Statement) on qualities that make up faithful representation.

Faithful representation in management commentary (Agenda Paper 15A)

The Board tentatively decided that the revised Practice Statement would:

- include guidance on the qualities that make up faithful representation—completeness, neutrality and freedom from error; and

- explain that these qualities should be maximised to the extent possible.

All 14 Board members agreed with this decision.

The Board tentatively decided that the revised Practice Statement would include a description of completeness based on paragraph 2.14 of the Conceptual Framework for Financial Reporting (Conceptual Framework). In particular, that description would explain that:

- a complete depiction of a matter should include material information about the nature of that matter and about factors and circumstances that might affect it.

- completeness of a depiction of a matter is determined by reference to primary users’ information needs. To be complete, a depiction of a matter does not necessarily require management to provide all information it has about that matter.

All 14 Board members agreed with this decision.

The Board tentatively decided that the revised Practice Statement would:

- require that the management commentary be neutral. To facilitate that:

- each matter that needs to be discussed in the management commentary should be given due prominence; and

- the overall tone and language used in management commentary should contribute to an unbiased depiction of the entity’s performance and position.

- include a description of neutrality based on paragraph 2.15 of the Conceptual Framework. In particular, that description would explain that, for the depiction of a matter to be neutral, information about it cannot be omitted, obscured, given undue prominence or otherwise be manipulated to influence primary users’ view of the matter favourably or unfavourably.

- require explanatory information to help primary users understand the likelihood of outcomes within a range when the range of possible outcomes is given.

All 14 Board members agreed with this decision.

The Board discussed what guidance on freedom from error should be included in the revised Practice Statement but did not make a decision on this topic. The Board also highlighted the importance of using plain language in describing the qualitative characteristics of useful financial information in the revised Practice Statement.

Next steps

The Board will discuss guidance on the enhancing qualitative characteristics of useful financial information and the content elements of management commentary, starting with the business model.

Disclosure Initiative—Targeted Standards-level Review of Disclosures (Agenda Paper 11)

The Board met on 25 September 2019 to discuss amendments to the disclosure objectives in IFRS 13 Fair Value Measurement.

IFRS 13 Disclosure Objectives (Agenda Paper 11A)

High-level, catch-all disclosure objective

The Board tentatively decided to include a high-level, catch-all disclosure objective in IFRS 13 requiring an entity to:

- disclose information that enables users of financial statements to evaluate an entity’s exposure to uncertainties associated with its fair value measurements. The disclosed information should, in particular, enable users to understand the significance of assets, liabilities and of an entity’s own equity instruments measured at fair value; how the fair value measurements have been determined; and how changes in those measurements affect the entity’s financial statements.

- consider the level of detail necessary to satisfy the specific disclosure objectives (also set out in this Update) and ensure that any useful information about the entity’s fair value measurements is not obscured by a large amount of insignificant detail.

Ten of 14 Board members agreed and four disagreed with this decision.

Specific disclosure objectives

The Board tentatively decided to include specific disclosure objectives in IFRS 13. These objectives would require an entity to disclose information that enables users of financial statements to:

- understand the amount, nature and other characteristics of the classes of assets, liabilities and an entity’s own equity instruments within each level of the fair value hierarchy. Thirteen of 14 Board members agreed and one disagreed with this decision.

- understand the significant techniques and inputs used in deriving its fair value measurements. All 14 members agreed with this decision.

- understand the drivers of changes in the fair value measurements from the beginning of a reporting period to the end of that period. All 14 Board members agreed with this decision.

- understand the range of reasonably possible fair values at the reporting date for the assets, liabilities and an entity’s own equity instruments measured at fair value. Thirteen of 14 Board members agreed and one disagreed with this decision.

The Board tentatively decided to require an entity that discloses the fair value of assets and liabilities not measured at fair value in the statement of financial position to disclose information that enables users of financial statements to understand the amount, nature and other characteristics of those assets and liabilities within each level of the fair value hierarchy. Ten of 14 Board members agreed and four disagreed with this decision.

The Board instructed the staff to consider how best to reflect its comments when drafting.

Other user information needs

The Board tentatively decided not to develop specific disclosure objectives to address the information needs of users of financial statements relating to forecasting of future fair value movements. All 14 Board members agreed with this decision.

Next steps

At a future meeting, the Board will discuss:

- items of information to meet the disclosure objectives in IAS 19 Employee Benefits;

- items of information to meet the disclosure objectives in IFRS 13; and

- lessons learned from the Targeted Standards-level Review of Disclosures testing process and potential amendments to the Board’s draft guidance on developing and drafting disclosure objectives and requirements in future.

Primary Financial Statements (Agenda Paper 21)

The Board met on 25 September 2019 to discuss:

- how to present the exposure draft that on 24 July 2019 the Board instructed the staff to prepare for balloting; and

- the number of illustrative examples of statement(s) of financial performance that should be included in the exposure draft in order to illustrate the Board’s proposals.

The Board tentatively decided to:

- present the exposure draft as a [draft] new IFRS Standard rather than as amendments to IAS 1 Presentation of Financial Statements. Twelve Board members agreed and two disagreed with this decision.

- reduce to a handful the number of examples of the statement(s) of financial performance illustrating the Board’s proposals for subtotals. (This tentative decision supersedes the tentative decision made by the Board at its meeting in November 2018.) Twelve Board members agreed and two disagreed with this decision.

Next step

The staff will continue to prepare the exposure draft for balloting.

2019 Comprehensive Review of the IFRS for SMEs Standard (Agenda Paper 30)

The Board met on 26 September 2019 to discuss the 2019 Comprehensive Review of the IFRS for SMEs Standard (2019 Review).

Scope of the IFRS for SMEs Standard (Agenda Paper 30A)

The Board decided not to seek views in the request for information to be published as part of the 2019 Review (request for information) on adjusting the scope of the IFRS for SMEs Standard to include some publicly accountable entities. Twelve of 14 Board members agreed and two disagreed with this decision.

New IFRS Standards—IAS 19 Employee Benefits (Agenda Paper 30B)

The Board decided to seek views on:

- retaining the current requirements in paragraph 28.24 of the IFRS for SMEs Standard on the accounting policy election for actuarial gains and losses. Twelve of 14 Board members agreed and one disagreed with this decision. One member was absent.

- not aligning the IFRS for SMEs Standard with paragraph 127 of IAS 19 with regard to the determination of remeasurements of the net defined benefit liability or asset. Twelve of 14 Board members agreed and one disagreed with this decision. One member was absent.

- aligning the recognition requirements for termination benefits in paragraph 28.34 of the IFRS for SMEs Standard with those in IAS 19. Eight of 14 Board members agreed and five disagreed with this decision. One member was absent.

- current practice and application issues relating to the use of the simplifications permitted in paragraph 28.19 of the IFRS for SMEs Standard under the ‘undue cost or effort’ exemption. Thirteen of 14 Board members agreed with this decision. One member was absent.

- not aligning Section 28 of the IFRS for SMEs Standard with the other amendments made to IAS 19 in 2011. Thirteen of 14 Board members agreed with this decision. One member was absent.

Questions and answers developed by the SME Implementation Group (Agenda Paper 30C)

The Board decided to seek views on:

- incorporating into the IFRS for SMEs Standard questions and answers developed by the SME Implementation Group;

- adding the definition of financial guarantee contracts from IFRS 9 Financial Instruments to the IFRS for SMEs Standard; and

- aligning with IFRS 9 the requirements for financial guarantee contracts issued by an entity.

Eleven of 14 Board members agreed and two disagreed with these decisions. One member was absent.

Previous Board decisions—IAS 23 Borrowing Costs (Agenda Paper 30D)

The Board decided not to seek views on whether and how to align the IFRS for SMEs Standard with IAS 23 Borrowing Costs. Eleven of 14 Board members agreed and two disagreed with this decision. One member was absent.

Cryptocurrency (Agenda Paper 30E)

The Board decided to seek views on whether holdings of cryptocurrency and issuances of cryptoassets are widespread and material among entities eligible to apply the IFRS for SMEs Standard. Nine of 14 Board members agreed and three disagreed with this decision. One member was absent.

The Board decided not to seek views:

- on possible alternative approaches to the accounting for cryptocurrency in the IFRS for SMEs Standard. Thirteen of 14 Board members agreed with this decision. One member was absent.

- on amending Section 34 of the IFRS for SMEs Standard to include requirements on the accounting for cryptocurrency. Twelve of 14 Board members agreed and one disagreed with this decision. One member was absent.

- on whether mining and staking activities are widespread and material among entities eligible to apply the IFRS for SMEs Standard. Nine of 14 Board members agreed and four disagreed with this decision. One member was absent.

Previous Board decisions—IFRS 11 Joint Arrangements (Agenda Paper 30F)

The Board asked the staff to bring a further paper on the alignment of IFRS 11 Joint Arrangements.

Summary of Board’s tentative decisions (Agenda Paper 30G)

The Board received a summary of its tentative decisions on the 2019 Review. The Board was not asked to make any decisions.

Next steps

In October 2019 the Board will consider sweep issues and whether to seek views in the request for information on IFRS 12 Disclosure of Interests in Other Entities. The Board expects to publish the request for information by the end of 2019.

Subsidiaries that are SMEs (Agenda Paper 31)

The Board met on 26 September 2019 to receive an update on its research project on Subsidiaries that are SMEs. In particular, the Board discussed the results of one of the two parts of the research; the Board discussed the results of the research on whether a Standard, if developed, would be adopted and applied.

The Board was not asked to make any decisions.

Next step

The results of the second of the two parts of the research, the staff analysis on whether the disclosure requirements of the IFRS for SMEs Standard can be used with only minimal tailoring, will be reported at a future meeting.

Extractive Activities (Agenda Papers 19–19F)

The Board met on 26 September 2019 to discuss recent developments in the areas addressed by the 2010 Extractive Activities Discussion Paper. The Board was also updated on the project’s research activities and planned outreach for the remainder of the year.

The Board was not asked to make any decisions.

Next step

The Board will discuss the feedback from outreach at a future meeting.

Post-implementation review of IFRS 10 Consolidated Financial Statements, IFRS 11 Joint Arrangements and IFRS 12 Disclosure of Interests in Other Entities (Agenda Paper 7)

The Board met on 26 September 2019 to discuss an update on the first phase of the post-implementation review of IFRS 10, IFRS 11 and IFRS 12. The Board was informed that the staff will start holding outreach meetings with stakeholders in October.

The Board was not asked to take any decision.

Next step

The Board will consider an additional update at a future meeting.