When: 30 November 2018

Where: Charlemagne building, Brussels, Belgium

Chair of the Trustees Erkki Liikanen delivered a keynote speech at a European Commission conference on the future of corporate reporting in a digital and sustainable economy. The conference focused on whether the EU legislative framework for corporate reporting needs to be adapted to better serve the capital markets and the EU economy.

Introduction

It is a great honour to speak at today’s event. The European Union was one of the first major jurisdictions to adopt IFRS Standards, so Brussels feels a good place for my first speech as Chairman of the IFRS Foundation Trustees.

History

From 1999 onwards I remember vividly discussions on the Financial Market Action Plans here in Brussels. They were started by Mario Monti and continued by Frits Bolkestein, both commissioners for the Internal Market. They were priority issues on the Lisbon Agenda. IFRS Standards became an important part of the Financial Market Action plan. We learnt to know IFRS Standards then.

Another prominent new issue at the time was the Internet and the use of ICT in increasing productivity. We learnt to know well ICANN, a non-profit organisation for databases and namespaces of the Internet.

Later, Jean Pisany-Ferry, the first director of Bruegel, wrote about these two institutions in his foreword to Nicolas Veron´s paper The Global Accounting Experiment. The internet and IFRS Standards are very different things, but from the governance perspective they presented similar challenges. Both were international developments, created by technicians operating largely in the private sector. Both were seen as innovative, market-driven solutions to global issues–the internet providing cross-border flows of digital information, whilst IFRS Standards provided cross-border flows of financial information. Moreover, both had their own governance arrangements which were new.

The Commission then ended up taking broadly the same view on both topics. We had no desire to create an EU version of the internet, and neither did we want to create EU version of IFRS Standards. You can see this in the way EU legislation was crafted. Regulation 3626/02 states that:

Companies must be required to apply a single set of high quality international accounting standards for the preparation of their consolidated financial statements. Furthermore, it is important that the financial reporting standards…are accepted internationally and are truly global standards.1

The regulation received strong support from the European Parliament, with 94% of MEPs voting in favour of the resolution.

Why did the EU decide to adopt IFRS as international standards, rather than adapt them into an EU GAAP?

First, the Asian Financial Crisis, coupled with accounting scandals here in Europe and the US—Enron, Parmalat and Worldcom—led to a huge loss of trust in the financial reporting system around the world. An international problem needed an international solution.2

Second, it was becoming increasingly clear that different accounting requirements of differing quality were adding cost, complexity and risk to companies and investors operating in the global market. IOSCO—the international forum for capital market regulators—had recently endorsed the use of IFRS Standards for cross-border listings, so the direction of travel towards international standards was becoming clear.

For these and other reasons, it made sense for the EU to standardise on IFRS Standards when creating the single market in financial services envisaged by the Lisbon strategy.

What has happened?

Since the EU’s momentous decision, we have seen good progress towards the objective of high-quality, global accounting standards.

The EU’s decision established a path to IFRS adoption that has been followed by most of the world. As Jean Pisani-Ferry has noted in the foreword I mentioned earlier3:

It was the EU’s landmark decision to cut short EU intergovernmental negotiations and endorse an outside standard instead of attempting to create one of its own which triggered similar responses by other governments and the spread of IFRS Standards the world over.

More and more countries have followed the EU’s lead and put their faith in the IFRS system, leading to widespread adoption of the Standards as the global language of financial reporting.

As of today, 144 out of 166 researched jurisdictions now require the use of IFRS Standards for all or most domestic listed companies and financial institutions. Although there are some notable exceptions, almost nine out of ten jurisdictions have now adopted our Standards. Of those that have adopted, two-thirds have no endorsement process at all.

In parallel, the IFRS system has provided a very effective mechanism for standard-setters to work together to improve the quality of accounting standards worldwide.

An early example of this work was to end the practice of stock options being awarded to senior management at seemingly no cost to the company or its shareholders— according to the financial statements anyway. Financial alchemy at its best!

We all know post-financial crisis reforms to financial instruments accounting and the new leasing standard that gives much greater visibility of burdensome lease obligations taken on by companies.

Dare I mention IFRS 17 and steps to bring insurance accounting into the 21st century?

Together, our collective efforts to upgrade IFRS Standards and encourage their use around the world has provided many benefits to both the global economy and its citizens. For me, this was brought into sharp focus when I met in Johannesburg with our Trustee from South Africa, Wiseman Nkuhlu. Wiseman is a person with a remarkable life story, and the first black Chartered Accountant in South Africa. He told me that the IFRS system was very important to Africa, because it was a critical framework for foreign direct investment, while the transparency provided by IFRS Standards helps governments to tackle fraud and corruption.

All things considered, the IFRS project has been a success at an international level. Is it also viewed as a success at an EU level? The answer to that is provided by the EU Fitness Check.

EU Fitness Check

Fitness checks are a tried-and-tested approach, and one that I support. It’s how the EU works. You assess existing legislation, you do a fitness check, and you draw conclusions. My sense is that this is a carefully drafted report by the Commission staff. The report seems to offer a balanced view of the opinions I hear in the field.

It was interesting to see the high levels of participation not only from within but also from outside of the EU. Many non-EU domiciled companies and investors have interests in the EU, so they will be affected by the EU’s policy choices in corporate reporting. Another plausible explanation is that the EU’s approach to corporate reporting, and in particular to IFRS Standards, is highly influential in shaping the policies of other jurisdictions— as was mentioned earlier.

Financial reporting

From an IFRS Standards and financial reporting perspective, the report shows that things are working well. People see the benefits of global standards and seem comfortable with the existing endorsement process. Not everything is perfect, but there is not much support for substantive change.

Most respondents felt that IFRS Standards are effective, helping to reduce the cost of capital and increase investments within the EU. Few believed that the Standards have led to procyclicality and short-termism, while most believed that the EU’s policy on IFRS Standards has promoted more integrated capital markets in the EU and internationally. This is encouraging feedback and shows the importance of our Standards to the EU’s Capital Markets Union project and the wellbeing of the global economy more broadly.

Against this general attitude, it is logical that more than three quarters of all respondents supported the status quo of a restricted endorsement process and argued against introducing a ‘carve-in’ mechanism to modify IFRS Standards used in the EU. They argued that that carve-ins could lead to an EU version of IFRS Standards, be detrimental to EU companies active globally and to foreign investments in the EU, and hamper the G20 objective of a single global high-quality accounting framework.

A minority did argue for a carve-in mechanism that, in their view would help the EU to exert greater influence on the standard-setting process of the International Accounting Standards Board (IASB).

This topic of influence is an important one and should not be dismissed. Every major jurisdiction sets out to influence the international agenda, and this is naturally relevant also for the EU. The EU signed up to IFRS Standards from the very beginning, has been a strong and vocal supporter of IFRS Standards as the global standard, and the EU has endorsed pretty much every standard the IASB has ever issued. So, I completely understand the desire to be highly influential in a process to create standards that are mandated for use across the EU.

The question is how best to exert that influence. To collect views, to analyse concerns, to present them well and to win the argument through logic and reason. The EU has a great deal of experience in this area, because that is how its own internal decision-making works.

From my years in Brussels, I remember the frustration when somebody started talk about opt-outs. Often it hardened the resolve of the others. Why to focus on the arguments of those who want anyhow to opt out at the end of the process?

That is the way many can see carve-ins. A carve-in is an ‘opt out’ clause from the international IFRS system, of which the EU is a major player. I understand the argument that a few others have this possibility, so why not the EU? But I have to say I am not convinced. The Fitness Check shows to me an EU endorsement system that is working well.

In his 2002 address to the European Commission here in Brussels, Paul Volcker said:

I recognise that it will be difficult at times to accept some of the decisions of the IASB on some of the most controversial issues facing accounting. However, if professional and independent standard-setting is to work, we must accept and respect the outcome of a process that incorporates adequate consultation, follows established decision-making procedures, and, most importantly, is well reasoned.2

Paul Volcker has been right on many things during his illustrious career, and I believe he is right on this. Rather than opt-outs, the best way for the EU to influence the IASB is through the quality of its work and the persuasiveness of its arguments. My role as Chairman of the Trustees is to make sure the IASB has the right people, the right processes and transparency in its decision-making so that the best arguments are the ones that win the day.

Non-financial reporting

Finally, let me say a few words about the Fitness Check responses on non-financial reporting.

Sustainability reporting is growing in importance. It also reminds me of how things were in financial reporting, before IFRS Standards. Requirements were largely determined at a jurisdictional level, with patchy use of available international standards that are mainly applied on a voluntary basis. Just as it did with IFRS Standards and financial reporting, the EU has a real opportunity to be a catalyst for change in non-financial reporting.

This is a very important topic, and I share the views of respondents about the increasing importance of the reporting of a company’s sustainability and environmental impact. Investors want to know what sort of risks these companies face in the long term, and ideally they want that information presented in a consistent manner.

This is the first year of the EU’s ‘Non-Financial Reporting Directive’, so most respondents to the consultation rightly felt that more time was needed to see how the Directive was working in practice.

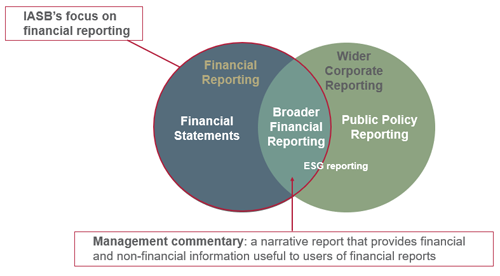

From an IFRS Standards perspective, the IASB is midway through a project to update its Management Commentary Practice Statement. Management commentary is a broad, voluntary framework that provides context for the financial statements— including topics such as those sustainability issues that may affect a company’s future financial results. As you can see from this diagram, the IASB refers to this area as ‘broader financial reporting’.

The original management commentary was issued in 2010, so this latest update will reflect new developments in integrated and sustainability reporting, and particularly the growing interest in long-term value creation. A consultative group for this project was created this year, and it includes representatives from EFRAG, ESMA and several European standard-setters. An Exposure Draft is planned for publication in 2020.

The IFRS Foundation is also cooperating with other bodies in this space, including the International Integrated Reporting Council, to ensure that we are aware of each other’s work and developments.

Close

Let me now conclude. If there is one message that I want you to take away from my remarks today, it is a desire to continue the excellent cooperation between the IFRS Foundation and the EU. IFRS Standards are a great example of EU leadership in establishing rules for global finance.

It has been a win/win for both the EU and the international financial system.

We are keen to work with you through the Fitness Check process, and in doing so ensure that IFRS remains fit for purpose and is able to address the challenges of the future.

Thank you

1 Europa.eu (2002), https://www.iasplus.com/en/binary/resource/euiasreg.pdf

2 Volcker (2002), https://www.iasplus.com/en/binary/resource/volcker0203.pdf

3 Bruegel (2007), http://bruegel.org/2007/04/the-global-accounting-experiment/