Date: 19 December 2019

Where: Paris, France

Chair of the International Accounting Standards Board Hans Hoogervorst delivered a speech at the 9th Symposium on Accounting Research hosted by the Autorité des Normes Comptables (ANC). He talked about the importance of high-quality accounting standards in supporting long-term investment.

I thank the ANC, and especially its President Patrick de Cambourg, for giving me the opportunity to address this symposium on the very important topic of ‘Accounting and the Long Term’.

I agree with everybody who thinks that the financial markets are plagued by short-termism. In our modern market economy, more than ever before, people work with other people’s money. With the increasing complexity of the economy, the distance between investor and investee has increased dramatically as well. Too many have too little ‘skin in the game’.

Management can be subject to the temptations of short-termism. Although executive pay is often linked to a company’s financial performance, all too often this performance is measured using unbalanced non-GAAP numbers, defined by management itself. Moreover, because the median tenure for CEOs is no longer than five years, management can be tempted boost a company’s short-term performance at the expense of long-term results.

Given these incentives for short-termism, high-quality accounting standards are essential. Good accounting supports long-term investment by giving accurate and timely information about financial performance, trends and risks. Accounting standards that aim to reflect economic reality as closely as possible help the company and its investors to navigate challenges in a timely fashion.

Some current IASB projects will help companies to better explain their long-term performance to investors. Today, I will speak about our work on Primary Financial Statements and the Management Commentary Practice Statement. I will also talk about the accounting treatment of equity investments.

Primary Financial Statements

First some words about the Primary Financial Statements project. Profit or loss will always remain an extremely important performance indicator, bringing together all strands of income and expenses. Nevertheless, we recognise that companies need subtotals to better explain their operational strategies and their performance. IFRS Standards currently do not provide such subtotals, which is one reason why the use of non-GAAP measures has proliferated.

In our Exposure Draft published earlier this week, we propose three new mandatory subtotals in the income statement, including an operating profit subtotal. The fact that operating profit will become an IFRS-defined number is the biggest improvement in these proposals. It is the most widely used subtotal by companies around the world, but it is currently a non-GAAP measure and, as such, subject to huge diversity in practice. Our research of 100 companies identified no fewer than nine definitions of operating profit.

For most companies outside the financial industry, the IFRS operating profit subtotal will exclude the financial impact of their investments and finance activities. So, if a company has a small portfolio of equity investments that are not part of its main business activities, its operating profit number will not be affected by any changes in the value of those equity investments. This will help companies better explain their operating performance.

Defining operating profit in IFRS Standards will enhance its status and comparability. It will therefore become a more powerful instrument for companies to explain their long-term performance to investors.

We also propose a note in which companies will have to identify elements of income and expense which are ‘unusual’ in the sense they have limited predictive value. Identifying unusual items is already a common way for companies to explain their long-term performance.

However, like operating profit, the presentation of unusual items currently belongs to the realm of non-GAAP. For some reason, companies often find it much easier to find unusual expenses than unusual items of income. It is the main reason why 80%–90% of non-GAAP measures present a rosier picture than numbers reported using IFRS Standards—and why investors tend to be sceptical of such numbers.

In our proposals, we provide guidance that will hopefully result in a more balanced picture of companies’ unusual items. This will help investors gain insight into the persistence of earnings. It will also help companies better explain their long-term strategy, regardless of the one-off expenses and windfall profits that can occur.

Management commentary

Next comes our work on the Management Commentary Practice Statement. We believe this project will be important in helping companies tell their long-term story to investors. Because the financial statements are primarily backward looking, they cannot fully explain the long-term strategy of a company. Elements that may be essential to a company’s long-term strategy often escape the financial statements, such as its business model, its intangible resources, the business environment it operates in, and more forward-looking information. A company therefore needs the narrative part of its annual report to adequately explain its long-term strategy.

One reason we decided to update our Management Commentary Practice Statement—our guidance to companies on how to write this narrative—is that it currently gives insufficient information on intangibles and sustainability, which are becoming critical a company’s long-term viability.

In the modern economy, intangibles like technology and the quality of a company’s human resources are increasingly decisive for its long-term viability. Yet most of these intangibles escape the financial statements. Management commentary can fill the gap.

It is also clear that sustainability issues, such as climate change, can pose formidable challenges to a company’s value creation over time. We need to provide guidance as to how to include these long-term challenges in management commentary, to the extent that they might affect future cash flows which are not (yet) captured by the financial statements.

Short-term volatility

All my references to the long term thus far, do not imply that we think that short-term economic phenomena are of secondary importance in accounting. If short-term volatility in the financial statements reflects real economic volatility, it should not be discarded or ironed out in an artificial way. Let me explain why.

An airplane flying from London to New York will spend most of its time pointing in the wrong direction. The direction of the plane is not determined by the pilot alone, but also by external factors such a wind speed and direction. The pilot needs to make continuous short-term corrections to achieve the long-term goal—to arrive safely in New York.

Business is no different. No long-term investor or executive can ever afford to ignore short-term fluctuations, if only because you never know how short the short-term will be. When I first gave a speech on this topic in 2013, central bankers called interest rates of around 1% ‘exceptionally low’. The expectation then was that interest rates would revert to historically normal levels before long.

Yet, the financial industry would have been ill-advised to disregard this fall in interest rates as ‘short-term volatility’. Six years later, interest rates in Japan and Europe have entered into negative territory, imposing severe strain on insurers and banks. Central banks do not see a rapid return to conventional policies; instead they stress that rates will remain ‘low for long’. The short term has become the long term.

So, beware of people who tell you that they only care about the long term and who do not want to be bothered by market values in the short term. Companies or investors that take a long-term view, must be able to withstand the inevitable short-term fickleness of the marketplace.

The pitfalls of ‘available-for-sale’ accounting

This brings me to my final topic, which is the accounting treatment of equity investments in IFRS 9, the financial instruments Standard. As you know, in IFRS 9 we abolished the available-for-sale—or AFS—category for equity investments. Fair value through profit or loss became the default requirement for equity investments. Ever since, some stakeholders—especially in the insurance industry—have suggested this accounting treatment is a disincentive for long-term investment in equity instruments as it could lead to more short-term volatility in the income statement.

The European Commission has asked EFRAG to look at such accounting; most recently, the Next CMU High-Level Group1 pleaded for the restoration of the AFS category for equities.

I understand why some experience nostalgia for AFS accounting. The AFS category for equity investments in IAS 39, the discontinued financial instruments Standard, provided a perfect instrument for companies to smooth their income statement over time.

In the AFS category, you only recognised profits on equity investment when you sold the financial instrument in question. The category was subject to impairment, but deciding when to impair was subject to judgement and there was wide variety in practice. Some companies only recognised losses after a prolonged decline in value of up to 50%. Despite many efforts, nobody has been able to come up with a robust impairment model for equity investments.

In practice, the AFS category gave companies ample leeway to decide when to recognise their gains and losses in their equity portfolios. Was that convenient? Certainly. But did it result in accounting that fully reflected economic reality? Not necessarily.

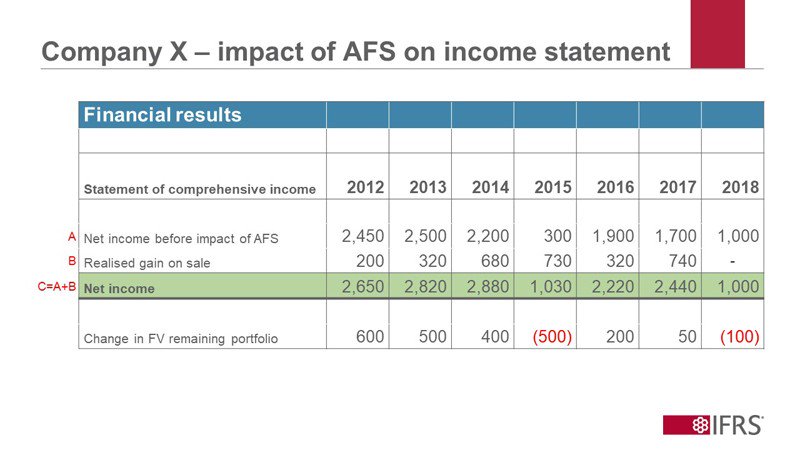

Let us take a look at the income statement of a company on which AFS investments have had a significant impact. It is a stylised example, ‘based on a true story’, reflecting the financial statements of an actual company. It is essentially a non-financial company, but it holds a large portfolio of investments in financial instruments to cover future obligations.

This seven-year overview clearly shows that this company tended to release larger quantities of AFS reserves when its net earnings before AFS were under pressure. Note especially how in 2015 large profits were realised on AFS investments, while the remaining investment portfolio suffered a loss. Without the contribution of AFS, profits in that year might have been all but wiped out.

Let me be clear, this accounting was perfectly in accordance with the requirements of IAS 39. No objective evidence suggests that the sale of equities was motivated by the desire to smooth earnings. After all, it could be that both in 2015 and 2017 the company had liquidity needs that motivated the sale of the investments in question.

However, given that this company holds their financial investments for the longer term, it is more likely than not that the profits on AFS in 2015 and 2017 were accumulated over a long period of time. Their sudden recycling from OCI in 2015 and 2017 therefore does not fully reflect the performance of the company in those particular years.2 Moreover, as a result of the AFS sales, the deteriorating performance of the company was less clearly visible in total net earnings. Instead in 2018, the release of AFS profits was no longer possible. Net income became visibly strained.3

From a long-term investment perspective, I strongly believe in accounting standards that minimise the scope for earnings management. Earnings management can obscure the true performance of a company by smoothing its profits over the years. It can mask a deterioration of profits, allow for unsustainable dividends and leave the investor in the dark as to the true performance of a company. AFS accounting can lead to fair-weather accounting, while in fact a storm may be brewing.

That is why I believe that fair-value through profit or loss accounting for equity investments is superior to AFS-accounting. Yes, it might result in some short-term volatility, but if you own equities you should be ready to deal with that.

Nevertheless, I am sure that the debate on AFS will continue in the coming years. It will probably be one of the hot topics in the Post-implementation Review (PIR) of IFRS 9. The PIR will provide the opportunity to collect objective evidence on the impact of removing the AFS category. We will—for example—be able to look at the experience of insurers around the world that have already adopted IFRS 9. The PIR will be concluded under the leadership of my successor and I am confident that she or he will bring this discussion to a satisfactory long-term outcome.

Conclusion

My conclusions in a nutshell: The IASB’s work on Primary Financial Statements and Management Commentary will help companies better tell their long-term story. Yet long-term goals should also be subject to the scrutiny of shorter-term performance measures. Otherwise, how would you know that you are on track? Finally, I believe ending AFS accounting was the right thing to do, but it will be an area to look at when we review IFRS 9.

![]() 1https://nextcmu.eu/wp-content/uploads/2019/10/The-Next-CMU-HL_DO.pdf

1https://nextcmu.eu/wp-content/uploads/2019/10/The-Next-CMU-HL_DO.pdf

![]() 2There is also a marked contrast in 2015 and 2017 between the high AFS-realisations and the fact that what happens in those years in OCI is actually poor compared with other years. Due to the split between ‘realised’ and ‘unrealised’ gains on sales, an unbalanced picture of the investment performance results in these periods.

2There is also a marked contrast in 2015 and 2017 between the high AFS-realisations and the fact that what happens in those years in OCI is actually poor compared with other years. Due to the split between ‘realised’ and ‘unrealised’ gains on sales, an unbalanced picture of the investment performance results in these periods.

![]() 3Proponents of returning to AFS-accounting acknowledge that it can be used for earnings management. However, they state that companies without AFS investments can do the same, for example by disposing of non-financial assets when earnings are under pressure. However, I find the argument of ‘everybody does it’ never very convincing. Also, selling non-financial assets is usually much more difficult than selling shares on the stock market. Companies may not be able to sell enough to make a discernible difference.

3Proponents of returning to AFS-accounting acknowledge that it can be used for earnings management. However, they state that companies without AFS investments can do the same, for example by disposing of non-financial assets when earnings are under pressure. However, I find the argument of ‘everybody does it’ never very convincing. Also, selling non-financial assets is usually much more difficult than selling shares on the stock market. Companies may not be able to sell enough to make a discernible difference.