The IFRS for SMEs Standard Update is a quarterly summary of news, events and other information about the IFRS for SMEs Standard and related SME activities. The staff summary has not been reviewed by the International Accounting Standards Board (Board).

Contents

As we end the summer break in the UK, it is great to see the progress we have made on the 2019 Comprehensive Review of the IFRS for SMEs Standard.

Alignment with principles

We got off to a slow start in the early part of the year as the Board set out the scope of the Review, and, perhaps at a higher level, what it thought the objective of the IFRS for SMEs Standard itself should be. The Board considered two approaches to the Review. The main objective of the first approach would be to align the IFRS for SMEs Standard with full IFRS Standards (alignment approach). The second approach would be to consider only issues raised by SMEs and users of their financial statements (independent standard approach).

The IFRS for SMEs Standard had originally been developed using the alignment approach. Although the Board did not achieve full consensus, it decided to proceed with the first stage of the Review on the basis that the IFRS for SMEs Standard should be aligned at a principles level with full IFRS Standards (alignment of principles). The Board also decided that to achieve an alignment of principles it would consider what information would be relevant to the users of SMEs’ financial statements, and what simplifications could be carried over from full IFRS Standards, or introduced, while still achieving faithful representation.

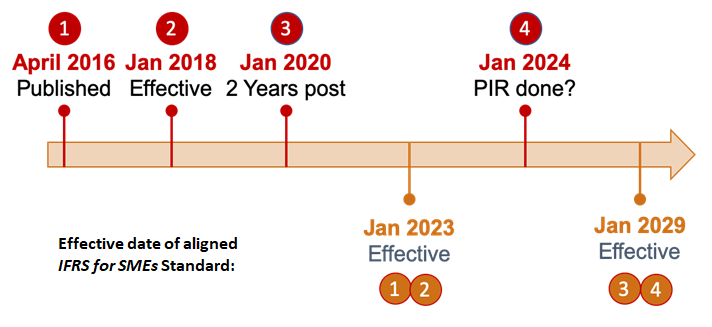

Having considered the alignment of principles as the starting point, the Board spent some time discussing the timing of that alignment. We identified four dates in the early life of a new or improved IFRS Standard, each of which could serve as an inception point for alignment. Using IFRS 15 Revenue from Contracts with Customers as an example, these dates are:

- the publication date—the date on which a new or improved Standard is published (April 2016);

- the effective date—the date on which the new or improved Standard becomes effective (January 2018);

- the implementation experience date—the date on which a reasonable amount of experience has been gained in applying the new or improved Standard, probably two years (January 2020); or

- the Post-implementation Review completion date—the date the Post-implementation Review of the new or improved Standard is completed (probably 2023 or 2024).

The advantage of aligning the IFRS for SMEs Standard later in the life cycle of the underlying IFRS Standard is that the Board would have benefited from the lessons learned in applying that IFRS Standard, which would facilitate more informed decision-making. The disadvantage is that the IFRS for SMEs Standard would remain unaligned with full IFRS Standards for longer, or, alternatively, that the IFRS for SMEs Standard would need to be amended more often. The Board has previously decided it would consider amendments to the IFRS for SMEs Standard approximately every three years. The diagram below illustrates the likely effective date of alignment with IFRS 15 under each of the approaches described above:

Using the completion date of the Post-implementation Review as the starting point, this diagram indicates that the IFRS for SMEs Standard would only be aligned with IFRS 15 for reporting periods starting in January 2029, some eleven years after it became effective as an IFRS Standard.

In the Request for Information the Board plans to publish later this year, we will ask stakeholders whether alignment with full IFRS Standards is important to them, and if so, what would be the best approach to achieve it

Considering new and amended IFRS Standards and IFRIC Interpretations

After the initial debate about alignment, the Board considered the IFRS Standards that have been issued or amended since the IFRS for SMEs Standard was originally issued, and that were not aligned in the previous review of the IFRS for SMEs Standard. In general, the Board has decided to seek views in the Request for Information to align all these Standards except for:

- IFRS 11 Joint Arrangements—because the changes are not substantive enough to justify the work required; and

- IFRS 14 Regulatory Deferral Accounts—because IFRS 14 may be replaced as a result of the Board’s current project on Rate-regulated Activities.

The Board has yet to consider its approach to IFRS 12 Disclosures of Interests in Other Entities.

In July of this year, the Board also considered IFRIC Interpretations of, and minor amendments to, full IFRS Standards and decided to seek views in the Request for Information the IFRS for SMEs Standard.

Next steps

At the Board’s next meeting, the staff will present papers on:

- differences between the IFRS for SMEs Standard and full IFRS Standards. Our focus will be on areas of difference where feedback has been received that users of the IFRS for SMEs Standard would prefer that it be more aligned with full IFRS Standards.

- matters of interest to entities applying the IFRS for SMEs Standard that are not currently covered by IFRS Standards, for example, topics such as cryptocurrency.

- whether to include Questions and Answers (Q&As) considered by the SME Implementation Group, which provide some application guidance about using the IFRS for SMEs Standard.

- Finally, the Board will be asked to consider the scope of the IFRS for SMEs Standard.

We expect to publish the Request for Information in the fourth quarter of 2019. It will ask a number of questions relating to the Board’s discussions and will allow you to contribute to the next phase of the project—the development of draft changes to the IFRS for SMEs Standard.

For a more detailed discussion of the Board’s decisions, read the monthly IASB Update. Papers and recordings of the Board’s monthly meetings are available here.

Discussing the IFRS for SMEs Standard at the Africa Congress of Accountants Conference

In June 2019 members of the IFRS Foundation staff attended the Africa Congress of Accountants in Marrakech, Morocco.

At the Congress—the continent’s fifth—Foundation staff led a session on the Review. Delegates discussed the role of the IFRS for SMEs Standard in emerging economies and the scope of the Review, including:

- the scope of the IFRS for SMEs Standard;

- the alignment of the IFRS for SMEs Standard with full IFRS Standards; and

- challenges in applying the IFRS for SMEs Standard.

Delegates generally favoured aligning the IFRS for SMEs Standard with full IFRS Standards, if doing so would not introduce unnecessary complexity. The delegates emphasised the importance of including emerging economies’ viewpoints during the Review and welcomed initiatives by the IFRS Foundation to facilitate participation by African constituents.

SME Implementation Group issues draft Q&A

In August 2019 the IFRS Foundation issued draft guidance on the IFRS for SMEs Standard, calling for stakeholder feedback. The guidance is being developed by the SMEIG.

The draft guidance is in the form of a draft question and answer (Q&A) document and addresses the application of the undue cost or effort exemption for investment property on transition to the IFRS for SMEs Standard.

Spotlight—The SME Implementation Group

The SME Implementation Group (SMEIG) supports the international adoption of the IFRS for SMEs Standard and monitors its implementation. The Group comprises members with different backgrounds, representing each geographical region. The European Commission and the European Financial Reporting Advisory Group hold observer status within the SMEIG.

The SMEIG is responsible for assisting the Board with matters related to the application of the IFRS for SMEs Standard. Developing timely guidance on specific accounting questions that have been asked on the application of the Standard is one of the two main responsibilities of the SMEIG. The other is to make recommendations to the Board regarding amendments to the Standard.

Follow the activities of the group on the SMEIG page.

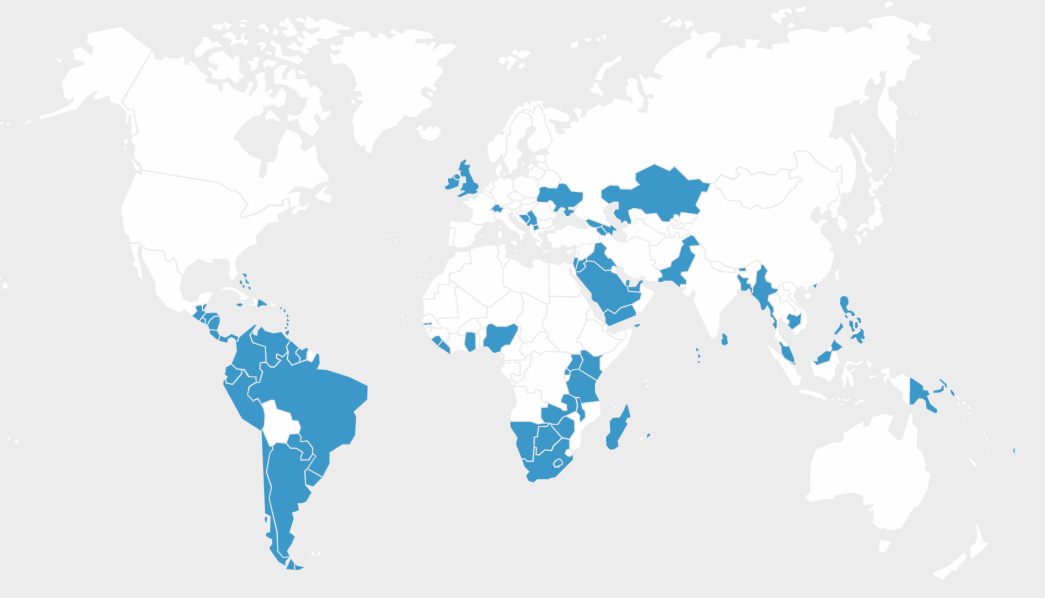

Countries where the IFRS for SMEs Standard is required or permitted